The Greek cruising tax ‘TEPAI’ or ‘eTEPAI’ commenced on May 2019. The tax applies to vessels over 7m and it must be paid prior to, or upon entry into Greek territorial waters.

TEPAI was first rumoured in 2014, sending a fairly sizeable roller of confusion throughout the sailing community. Whilst the application and online payment process does have its quirks, it does actually work. We’ve been asked a few times about TEPAI, so this is our step-by-step guide to getting your payment in and avoiding those fines. Any extra questions, feel free to ask us. Otherwise good luck, and remember… a fine is a tax for doing wrong, whereas a tax is a fine for doing well.

Our 3-step guide to paying your TEPAI Greek cruising tax online:

Click here to register and pay your TEPAI online

If you’ve paid your Greek cruising tax in the past and already have an account, you can go ahead and skip to step 2 to renew for another trip.

Step 1 – Make sure you are registered with the Greek Cruising Tax portal:

- Go to – https://www1.aade.gr/aadeapps2/etepai/

- Select a flag to choose your preferred language

- Click ‘Register’

- Fill in the short form and wait for a confirmation email

- Click the ‘here’ button in the verification email and login

Step 2 – Submit a new application to pay TEPAI

- Click on ‘New application’

- Select your vessel type

- Complete the vessel information within each section ‘Ship Info’, ‘Person Info’ and ‘TEPAI Info’

- If you need a break, you can always save and return to your application by clicking the ‘Temporary Submitted’ (green button)

- When you are happy with your answers go ahead and hit ‘Submit’ (red button)

- You should then receive an email with TWO attachments. Print both of them off and save them digitally. You will need to show these to the port police on arrival.

Step 3 – Pay your Greek cruising tax online

- First, find your 20-digit ‘eParavolo’ (numbers) payment code within the email attachments

- Login to your online banking

- Setup a new overseas payment

- Enter the following recipient information:

- Recipient Bank: International Authority for Public Revenue (AADE)

- Address (if requested): Sina 2-4, Athens, 106 72

- Swift code: BNGRGRAA

- IBAN: GR1201000230000000481090510

- Remittance Info: [insert your 20-digit payment code] – this one is VERY important to get right(!), if you don’t include this accurately, the payment will not be recorded against your application and you could be fined.

- Select the option to pay in Euros

- Submit payment and take a screenshot, photo or print the confirmation as evidence of payment.

- The payments are taken at 3pm (CET) each day, so this is when you can expect the funds to be withdrawn from your account.

- After a couple of days, login to your eTEPAI account once more and check payment has been received. Your payment status can be found to the right of your application and it should read ‘ΠΛΗΡΩΜΕΝΟ’, which is Greek for ‘paid’.

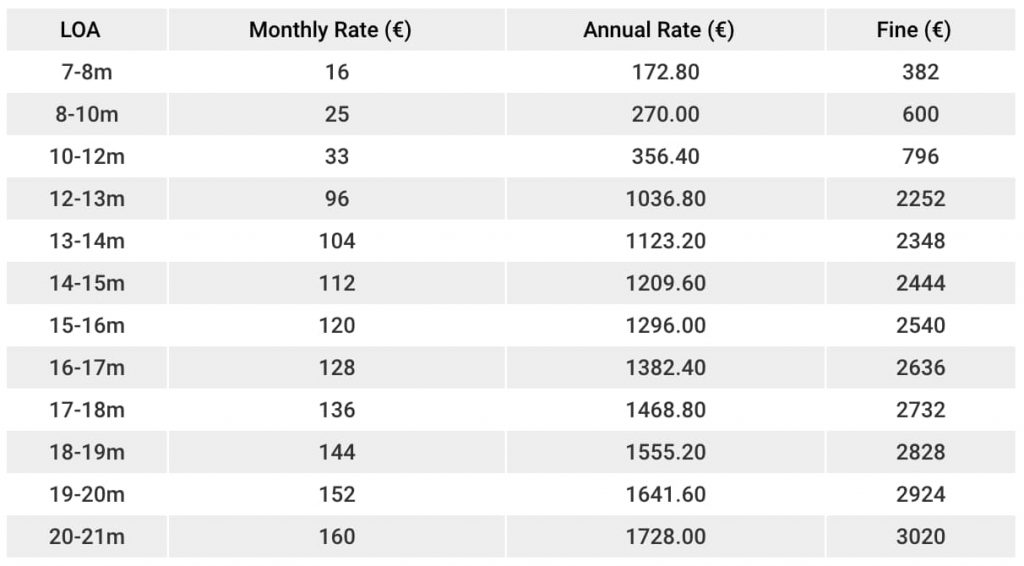

How much does the Greek cruising tax cost?

Tips and Tricks

- The postcode field will only accept five characters, so remove any spaces and only insert the first five.

- Make sure there are no spaces between the characters of your 20-digit eParavolo code.

- Our bank wouldn’t allow for 20-digits to go in the ‘remittance info’ or ‘reference’ box, so we had to use a different bank account. So seriously, double-check your eParavolo!

- If the International Authority for Public Revenue (AADE) rejects your payment. Firstly, double-check you entered your eParavolo code correctly. Otherwise, you can try another registered Collection Authority, for example, the Bank of Greece:

- Recipient Bank: BNGRGRAA (Bank of Greece)

- IBAN: GR1201000230000000481090510

- Make sure you print off what you can and save as much as possible digitally, this will just make your life easier with the Port Authorities.

Greek Cruising Tax – Frequently Asked Questions

There is a 10% discount if you pay your TEPAI in December for the following year in advance. Or you may pay in January for the current year. Otherwise, the tax is charged at a monthly rate, based on the length of your vessel (as per your Certificate of Registry):

7 – 8m = 16euros/month

8 – 10m = 25euros/month

10 – 12m = 33euros/month

Over 12m = 8euros/month and per metre (sorry guys)

These length brackets are pretty strict too (up to two decimals). So with Caladh being 10.3m, she falls into the 33euro a month bracket.

You pay for every month you are cruising in. So if you are cruising for some time within September, the TEPAI is payable for the entire month of September. Payment allows the vessel to stay in Greek territorial waters up to the first three days of the next month (e.g. until 3rd October). If the vessel will stay beyond three days of the next month (e.g. 4th October), then TEPAI must be paid before the start of October – so basically, it’s best not to chance it(!)

Yes. You can pay the TEPAI in December for the following year in advance, or you can pay in January for the current year. In both cases, you receive a 10% discount – happy days.

Yes. You can select the months you plan to cruise, whether they are successive or not. So you could select April, May, September and December if you wanted.

For vessels entering Greek territorial waters, you need to pay prior to entry or immediately upon entry at the latest. Afterwards you should pay TEPAI for each month of stay in Greek territorial waters, either on a monthly basis (before the start of each month); or for multiple months at a time.

For vessels being in Greek territorial waters, you need to pay for each month of stay in Greek territorial waters before the start of each month, or for multiple months at a time.

No. If your vessel is ‘out in use’, for example in a marina over winter, or out of the water on the hard then you are exempt from paying Greek cruising tax – but dependent on your circumstances you might need to officially declare this:

If the boat is on dry land then you do not need to declare immobility, however, from our experience we have found it helpful to keep boatyard receipts to immediately answer any port authority questions and as extra immediate proof just in case.

If the boat is going to remain in the water, then you need to visit the nearest Port Authority and complete a statement declaring its ‘out of use’ status.

Vessels are exempt for as long as they are seized; classified as a traditional ship; decommissioned, or declared “out of use” and certified by the Port Authority (see previous question).

No. The DEPKA cruising log has now been abolished. The DEPKA form was not a cruising tax, more of a cruising log or permit, although you did pay a nominal fee for it on arrival and it did need renewing every year. It has now been superseded by the TEPAI.

If you have a specific question that is not covered above, you can check out the Greek Independent Authority for Public Revenue FAQs here. Otherwise, we hope this has been helpful. Do let us know how you get on in the comments below and most of all, enjoy cruising Greece!

Much love, Kath and T.

8 comments

Thanks you very much for this post. I really helped me today.

Hi Willem, we are so glad you found it useful, thank you for your comment and all the best!

Amazingly that seemed to work! Thanks for the clear advice

Very useful but I have still managed to mess up!

I somehow managed to apply twice with incorrect details. I would like to delete one application and edit the other then pay.

Any advice much appreciated!

Thanks

So sorry for slow/no reply. Hope you sorted it and Greek sailing made up for it all 🙂

Thanks guys, very informative and helpful. My only question is, it’s now December 2022, and Im going to pay for 2023. Does the same rules still apply? Governments have a tendency to change things as we go along.

Very useful, thanks!! saved in bookmarks 🙂

2 Brits here, very close of buying a boat in Greece.

Did you buy it privately?

Have you registered it as UK vessel with (SSR) and do you have a British flag?

What should we keep in mind for having peace of mind with the coast guard?

Many thanks in advance

Hi Michele, oh this is very exciting, congratulations! We bought the boat through a broker in Preveza and yes it was already British flagged and on Part 1 register (not SSR). Re. coastguard – make sure all your emergency devices are registered (MMSI, EPIRB, PLBs etc.), but also one thing to note in Greece is be warned about making a PanPan.. it’s one of the only countries where this can cause more grief than it solves. Hope this helps and don’t hesitate to message us if you have any more questions – happy to help where we can! Otherwise, good luck and fair winds!